Control Equity

Value Creation and Legacy Preservation

Centerfield Equity collaborates with like-minded owners and management teams seeking a change of control transaction to accelerate business transformation. We focus on lower middle market businesses, investing equity across a variety of industry verticals.

FOUNDER FOCUSED

The sale of your company is a life-changing event, significantly impacting your family, employees, customers, and community. We deeply respect the road traveled to reach this point of inflection. Our goal is to elevate rather than re-build what has been achieved to-date. Further, it is our job to invest in the people that have worked hard to bring your dream to fruition. Our team is committed to tailoring a transaction to achieve shared goals, all while honoring and preserving your company’s legacy.

Our Approach

We are a relationship focused firm, and for 20+ years our mantra has been to cultivate long-term partnerships. People, and how they thrive together, are the essence of a successful business. Our intention is to collaborate with like-minded folks and dedicate significant resources to take their vision to the next level of success.

We Collaborate with Management

We have no desire to replace management. Alternatively, we seek to underwrite a strong management team and provide consultation, leaning on our many years of experience across various industries and economic cycles. We will be a shared steward, but ultimately give management the flexibility to operate and execute on a common plan.

We Leverage our Resources

On each transaction we deliver the totality of our financial, operational, and business development resources. We can also tap our external network of third-party providers and advisors, including operating partners, co-investors, lenders, and consultants. We have a deep bench of supportive business professionals to provide strategic consultation and resources to support growth initiatives.

We Invest to Scale

Growth rarely comes without capital investment – both infrastructure and human resources. We focus exclusively on lower middle market companies, and in our experience, it is critical to build a foundation early in an investment to achieve and sustain growth. We take a prudent approach to laying the groundwork to effectively scale, thus enhancing sales, finance, systems, etc., as necessary.

We Align Economic Incentives

We prefer key members of the management team to invest alongside us. Additionally, owners can achieve a second bite at the apple by retaining significant ownership post-close. There is considerable flexibility as to how we can structure each transaction, but economic alignment and shared upside has been a general tenet for us for many years.

We Exhibit Maturity and Patience

The path to value creation is rarely linear and can be materially impacted by economic cycles or company-specific issues. While our typical investment hold is five to seven years, we have no formal timing restrictions. Ultimately, we collaborate with co-investors and management to determine the appropriate time to exit, accounting for all stakeholders.

We Adhere to our Principals

We strive to nurture a collaborative culture founded on the core principals of honesty, transparency, responsiveness, and hard work. Business owners and company management need to trust that their financial partner will behave with the utmost integrity. We hold ourselves to the highest levels of professionalism and our reputation is critically important.

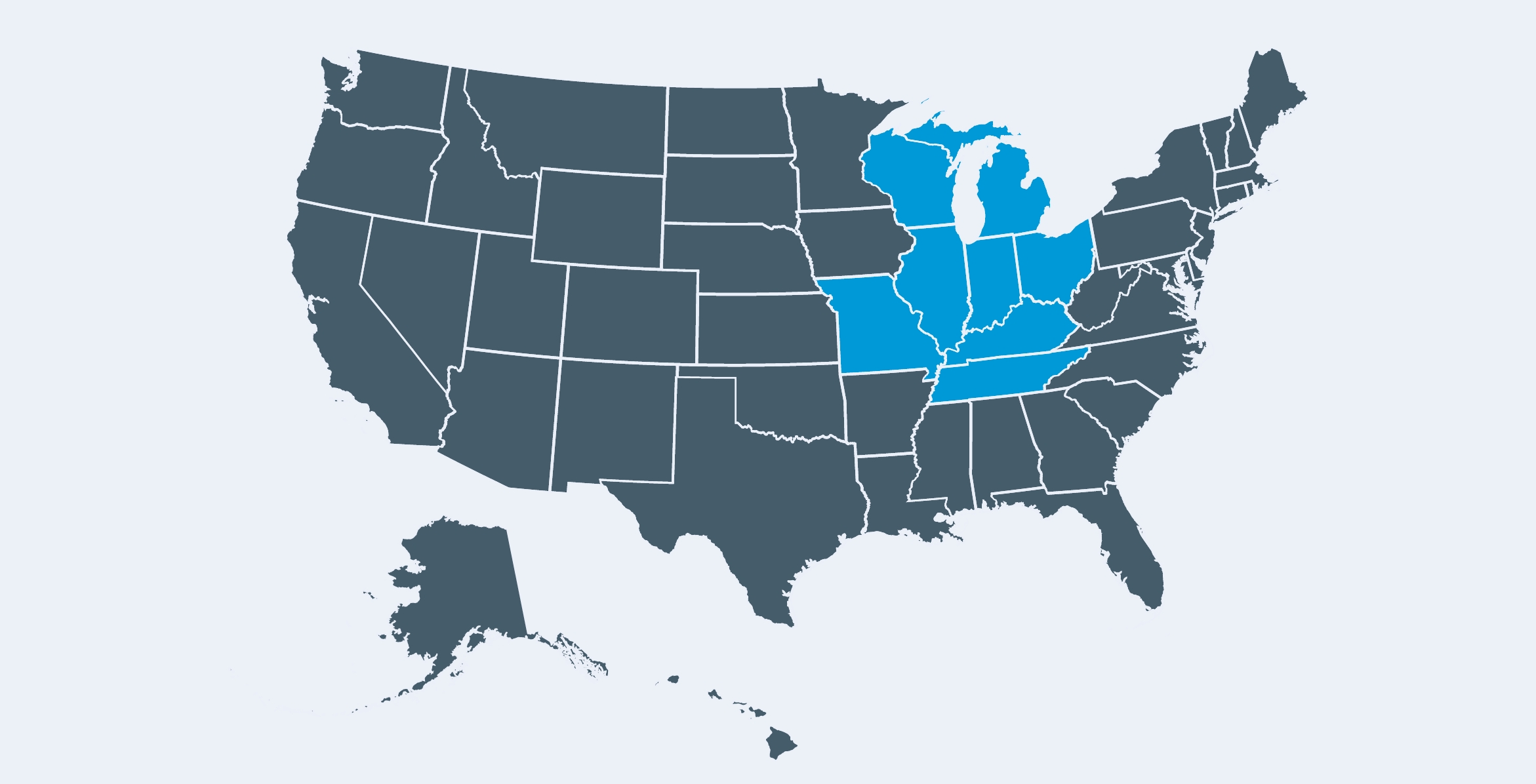

MIDWESTERN FOCUS

Centerfield Equity targets businesses in the middle of the country, preferably driving distance or a short flight from our Indianapolis office. We are proud of our Midwestern heritage, lean on our Midwestern perspective, and are sincerely passionate about the well-being of the industries and communities in the region.

Investment Criteria

EBITDA

- $1.5 to $5 million

- Margins generally > 10%

Company Characteristics

- First institutional capital

- Management continuity post-transaction

- Positive industry trends

- Stable and/or growing market

- Stable and profitable growth

- Strong market position

- Sustainable margins

Industry Interests

- Business Services

- Consumer Products

- Healthcare Services

- Manufacturing

- Value-added Distribution

Location

- Headquartered in the Midwest, or easily accessible from Indianapolis

- Tuck-in acquisitions can be located anywhere

Transaction Types

Control equity, supporting:

- Owner recapitalization / liquidity event

- Family succession

- Management buyout of closely-held business

- Corporate divestiture

Investment Size

- No formal restriction, albeit we target lower middle market companies

Types of Investments

- Common and preferred equity

Representative company characteristics, including financial figures, may differ than those depicted above.

We pay competitive feeds to intermediaries who introduce us to situations that result in closed transactions.

To discuss new investment opportunities, please contact:

Augie Pence: augie@centerfieldcapital.com

Troy Clark: troy@centerfieldcapital.com